Industry

Manufacturing - Tools & Accessories

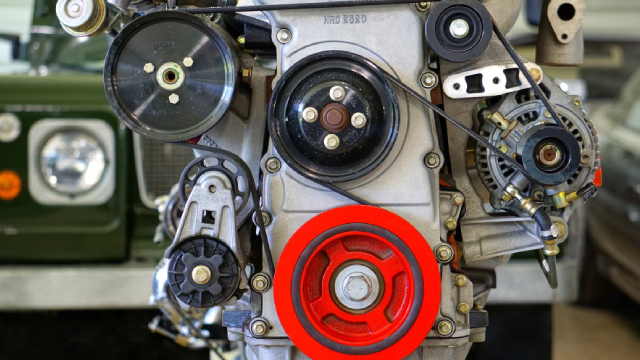

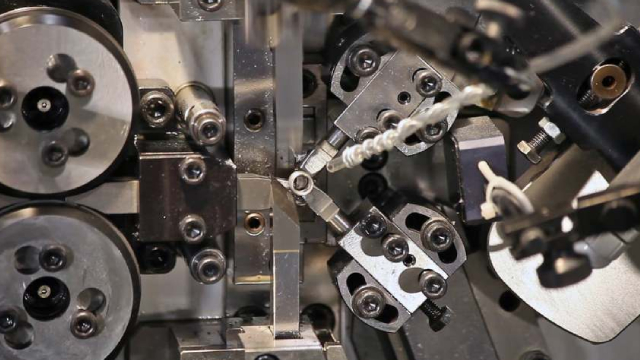

Snap-on Incorporated manufactures and markets tools, equipment, diagnostics, and repair information and systems solutions for professional users worldwide. It operates through Commercial & Industrial Group, Snap-on Tools Group, Repair Systems & Information Group, and Financial Services segments. The company offers hand tools, including wrenches, sockets, ratchet wrenches, pliers, screwdrivers, punches and chisels, saws and cutting tools, pruning tools, torque measuring instruments, and other products; power tools, such as cordless, pneumatic, hydraulic, and corded tools; and tool storage products comprising tool chests, roll cabinets, and other products. It also provides handheld and computer-based diagnostic products, service and repair information products, diagnostic software solutions, electronic parts catalogs, business management systems and services, point-of-sale systems, integrated systems for vehicle service shops, original equipment manufacturer purchasing facilitation services, and warranty management systems and analytics. In addition, the company offers solutions for the service of vehicles and industrial equipment that include wheel alignment equipment, wheel balancers, tire changers, vehicle lifts, test lane equipment, collision repair equipment, vehicle air conditioning service equipment, brake service equipment, fluid exchange equipment, transmission troubleshooting equipment, safety testing equipment, battery chargers, and hoists, as well as after-sales support services and training programs. Further, it provides financing programs to facilitate the sales of its products and support its franchise business. The company serves the aviation and aerospace, agriculture, construction, government and military, mining, natural resources, power generation, and technical education industries, as well as vehicle dealerships and repair centers. Snap-on Incorporated was founded in 1920 and is based in Kenosha, Wisconsin.

Loading...

Open

327.21

Mkt cap

17B

Volume

358K

High

332.67

P/E Ratio

17.01

52-wk high

373.90

Low

325.00

Div yield

0.02

52-wk low

252.98

Portfolio Pulse from

February 28, 2025 | 6:45 pm

Portfolio Pulse from

February 17, 2025 | 3:45 pm

Portfolio Pulse from

February 14, 2025 | 3:30 pm

Portfolio Pulse from

February 13, 2025 | 11:15 pm

Portfolio Pulse from

February 06, 2025 | 7:00 pm

Portfolio Pulse from

February 06, 2025 | 6:30 pm

All corporate logos and prices are for illustrative purposes only and are not a recommendation, an offer to sell, or a solicitation of an offer to buy any security.